What You Need to Know About Work Injury Settlements

A work injury settlement is a one-time payment that resolves your workers’ compensation claim instead of receiving ongoing weekly benefits. Here’s what you need to know:

Key Settlement Facts:

- Average Range: Most settlements fall between $20,000-$40,000

- Coverage: Medical bills, lost wages, disability benefits

- Process: Voluntary agreement between you and the insurance company

- Rights: You may give up future medical care or reopening claims

- Timeline: Can take 12-18 months or longer to reach agreement

When you’re hurt at work, the workers’ compensation system helps you recover without having to prove fault. With millions of nonfatal workplace injuries reported annually, it’s a critical system for injured employees.

The settlement amount depends on several factors: your injury’s severity, which body part was hurt, your age, average weekly wages, and medical costs. Some injuries never settle – especially if you need ongoing medical care or haven’t reached maximum medical improvement.

Settlement decisions are permanent. Once you accept, you typically can’t reopen your case or ask for more money later, even if your condition gets worse.

I’m Jason Fine, and for over 25 years, I’ve helped injured workers in Pennsylvania and New Jersey steer settlement negotiations. My experience ensures clients understand their rights before making permanent decisions.

How is a Work Injury Settlement Calculated?

When you’re dealing with a workplace injury, one of the biggest questions on your mind is probably “How much is my case worth?” Calculating a work injury settlement is a complex process, not a simple formula.

Every settlement calculation starts with your disability rating, impairment rating, average weekly wage (AWW), and all medical costs. Each state has specific laws that can dramatically change these numbers. What might get you $30,000 in Pennsylvania could be completely different in another state.

Key Components of a Settlement

Your work injury settlement should cover all past and future costs related to your injury. Here’s a breakdown of what’s included.

Medical expenses are often the largest part of a settlement. This includes past bills for doctors, hospitals, and therapy, as well as projected future medical needs like ongoing treatment or surgeries.

Lost wages cover income missed due to your injury. While recovering, you typically receive temporary disability benefits (about two-thirds of your average weekly wage) until you return to work or reach maximum medical improvement.

If your injury causes permanent limitations, you may qualify for Permanent Partial Disability (PPD) benefits. This compensates for the permanent loss of function. PPD calculations vary by state and are often based on an impairment rating.

If you can’t return to your old job, vocational rehabilitation costs can be part of your settlement. This includes retraining, education, and job placement services.

To prove these expenses, you need solid documentation: all medical bills and records, pay stubs showing wage loss, doctor’s notes on work restrictions, and receipts for all related costs like medications or travel to appointments.

Factors That Influence Your Settlement Amount

Beyond the basic components, several other factors can significantly impact your work injury settlement amount.

The severity of your injury is the biggest factor. A minor sprain results in a smaller settlement than a severe injury requiring surgery and causing permanent limitations. Injuries needing lifelong care lead to much higher settlements.

The injured body part also matters. Different body parts have different values in workers’ comp systems, reflecting their importance to your ability to work.

| Injured Body Part | Average Total Cost | Medical Cost | Indemnity Cost |

|---|---|---|---|

| Head or Central Nervous System | $93,942 | $60,875 | $33,067 |

| Multiple Body Parts | $62,859 | $32,647 | $30,212 |

| Hip, Thigh, or Pelvis | $59,758 | $36,553 | $23,205 |

| Leg | $59,748 | $38,049 | $21,699 |

| Neck | $59,391 | $30,404 | $28,987 |

| Arm or Shoulder | $49,116 | $26,088 | $23,028 |

| Lower Back | $37,966 | $17,486 | $20,480 |

| Upper Back | $36,754 | $17,799 | $18,955 |

| Knee | $34,932 | $18,293 | $16,639 |

| Face | $33,081 | $18,435 | $14,646 |

| Ankle | $21,894 | $17,534 | $14,360 |

| Foot or Toes | $27,893 | $15,264 | $12,629 |

| Multiple Trunk or Abdomen | $27,141 | $16,933 | $10,208 |

| Hand, Fingers, or Wrist | $25,904 | $14,669 | $11,235 |

| Chest or Organs | $21,339 | $11,045 | $10,294 |

Your age also influences the settlement. A younger worker with a permanent disability may receive a higher amount to cover more years of lost earning capacity. Some states use age multipliers in their calculations.

Pre-existing conditions can complicate settlements. Insurers may argue your problems existed before the accident. However, if the work injury worsened a pre-existing condition, you are still entitled to benefits, though the calculation is more complex.

Your impairment rating is crucial after you reach maximum medical improvement. A doctor assigns a percentage reflecting your permanent functional loss, based on guidelines like the AMA Guides. This rating directly impacts your PPD benefits and settlement amount.

Understanding State-Specific Rules for a Work Injury Settlement

Work injury settlement rules vary dramatically by state. What applies in one state may not in another, so work with attorneys who know your state’s specific laws.

At J. Fine Law, we focus on Pennsylvania and New Jersey, and we know these states’ workers’ compensation laws like the back of our hands. Both states operate under specific statutes that dictate how benefits are calculated, what timelines you need to follow, and how settlements work.

Pennsylvania and New Jersey have “no-fault” workers’ compensation systems. You don’t have to prove employer fault to get benefits, but this means you generally can’t get compensation for pain and suffering through a workers’ comp claim.

An exception is a third-party claim. If someone other than your employer or coworker caused your injury (like a negligent driver or equipment manufacturer), you may file a separate personal injury lawsuit. This type of claim can include pain and suffering damages. For complex cases in New Jersey, see our New Jersey Workplace Accident Lawyer page for more information.

Time limits are critical. You must report your injury to your employer, usually within 30 days, and file your claim within the state’s statute of limitations (often one to three years). Missing these deadlines can cost you your right to benefits.

The bottom line is that settlement calculations are complex, and state-specific rules are crucial. Experienced legal guidance is essential to getting the full compensation you deserve.

The Settlement Process and Your Legal Options

Getting a work injury settlement can feel like a chess match with the insurance company. The process often involves several strategic steps.

Most settlements happen through negotiation. Your attorney presents your case to the insurance company, which typically makes a counteroffer. This back-and-forth continues until both sides agree on a fair amount.

Sometimes, insurance companies deny claims, arguing the injury wasn’t work-related or that you missed a deadline. A denial is not the end; you have legal options.

If your claim is denied, you can appeal to your state’s workers’ compensation board. With strong legal help, many denied claims are approved on appeal. If negotiations fail, your case may go to a hearing, where a judge makes a final decision.

Hearings are unpredictable for both sides. A judge could award more or less than the settlement offer. This uncertainty is why most parties prefer to settle out of court, maintaining control over the outcome.

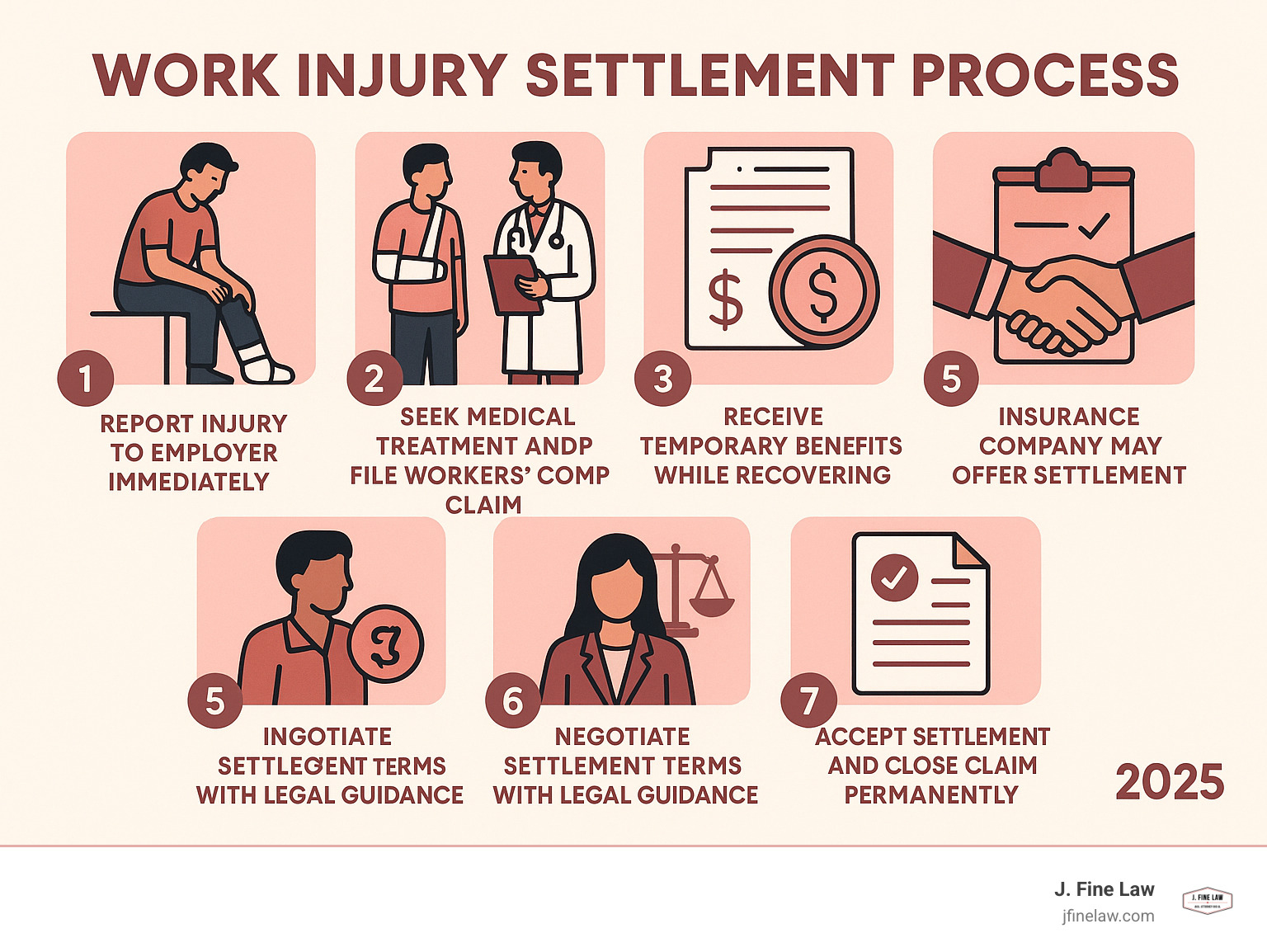

Steps to Take After a Workplace Accident

After a workplace accident, you may feel overwhelmed and in pain. Taking the right steps immediately can make a huge difference in your work injury settlement.

- Report your injury immediately to a supervisor. Even if it seems minor, report it. Most states have a 30-day reporting deadline, and waiting can jeopardize your claim.

- Get medical attention promptly, even if you feel fine. Adrenaline can mask symptoms. Tell the doctor your injury is work-related to create a crucial medical record.

- File your claim properly. Work with your employer to complete all paperwork accurately. You will likely need to fill out a “Worker’s Claim” form in addition to your employer’s report.

- Document everything. Keep detailed records of conversations, medical bills, receipts, and pay stubs. Take photos of the accident scene and your injuries if you can.

These steps protect your rights and strengthen your case. For more detailed guidance specific to Pennsylvania workplace accidents, visit our comprehensive guide: Workplace Accidents.

Lump Sum vs. Structured Settlements: What’s the Difference?

When it comes time to receive your work injury settlement, you’ll face an important choice: take all the money at once or receive it over time. Both options have pros and cons, and the right choice depends on your situation.

Lump sum payments provide the entire settlement in one check, offering control and immediate funds for debts. However, the money can run out, and you can’t ask for more if your condition worsens. Accepting a lump sum usually means giving up rights to future medical care for the injury.

Structured settlement annuities provide regular payments over time, sometimes for life. These payments are typically tax-free and offer long-term financial security, which is valuable for permanent disabilities or ongoing medical needs. The trade-off is less flexibility and no immediate access to the full amount.

Before choosing, consider your urgent financial needs, future medical costs, and comfort with managing a large sum. Also, think about other income sources, tax implications, and whether you need ongoing support versus a clean break.

Why Accepting a Work Injury Settlement Requires Legal Guidance

Accepting a work injury settlement is a major financial decision. It’s not just about the money; it’s about understanding the rights you’re giving up for your future.

When you sign a settlement, you are almost always waiving your future rights for that injury. You can’t ask for more money later, even if your condition worsens. An experienced attorney ensures you don’t accidentally give up rights to future medical care or other benefits.

Many worry about attorney’s fees, but in workers’ comp cases, they are regulated by state law and are a percentage of your settlement. You pay nothing upfront; we only get paid if we win or settle your case. This provides access to legal help without retainers or hourly rates.

Tax implications can be tricky. Generally, settlements for physical injuries aren’t taxable, but there are exceptions, especially if you receive Social Security Disability benefits. We help structure your settlement to be as tax-advantageous as possible.

At J. Fine Law, we’ve seen too many injured workers accept settlements that were far less than they deserved simply because they didn’t understand their rights. With our 98% success rate and over $50 million recovered for clients, we know how to fight insurance companies and secure fair compensation.

We provide rapid attorney response when you need answers most, and we’ll walk you through every detail of your settlement agreement before you sign anything. Don’t steer this complex process alone – learn more about your rights after a workplace accident and let us help you make the best decision for your future.